December 30, 2022

✋See our new website library of past IntualityAI Magazine Issues (password is intuality821)

Financial analysts are particularly bad at predicting, by Howard Rankin

Predicting the future is hard; monetizing it is even harder, by Michael Hentschel

Financial analysts are particularly bad at predicting

“Are you going to join me and Mary in our New Year’s Eve celebration?” asked Watson.

“The advent of the new year is one of the most misleading days of the calendar. It’s just another day on the calendar. Yet, everyone acts as if it is some Messianic sign of change. A time to change your behavior, your outlook, everything. A time to predict the year ahead and think of the future. In that sense every day should be New Year’s Eve, not just one day on the calendar,” said Holmes.

“Is that a ‘no’ then?” remarked Watson

“Your powers of deduction get better all the time, Watson. I guess it is because a new year is approaching.”

Just a date on the calendar, but one that we react with emotion and prescience, or so we believe.

In a recent CNN news piece (Wall Street’s dirty secret: It’s terrible at forecasting stocks) the author pointed out that financial analysts are particularly bad at predicting the fate of the markets in the upcoming year. That’s partly because January 1st frames (or anchors) the narrative to a twelve-month period. And given the many factors, known and unknown, that can affect the market, it is not surprising that predicting where the market will be in twelve months time is challenging.

As Sherlock says of such prediction, “It is typically sub-standard and poor.”

So, we need to be aware, that the advent of the new year can frame our thinking to the long term, which is no bad thing in itself as it might help overcome temporal discounting, the bias of ignoring or discounting the future. However, December 31st does not endow us with superpowers. And moreover, the dopamine flow of New Year’s Day that may motivate you temporarily to seek higher goals and outcomes, will inevitably stop or even dry up, possibly within 24 hours.

So, while looking to the future is an admirable tactic, there’s no time like the present.

by Howard Rankin PhD, psychology and cognitive neuroscience

Predicting the future is hard; monetizing it is even harder

Predicting the future is hard; monetizing the future with consistent outperformance is even harder. For financial markets, there is nothing standard about IntualityAI’s approach to stock market stock-picking, picking up human behavioral patterns, correlation to environmental non-financial trends that might impact stock price trends, and time-tested adjustments to securities price forecasts based on historical human reaction to price changes. Automation of trading with these behavioral dimensions in the AI Algorithm is now in place with Interactive Brokers and to a more limited extent with small-portfolio Robin Hood. This is a unique set of replicable tools that can be applied to portfolios of Futures and any marketable securities that have organized electronic exchanges.

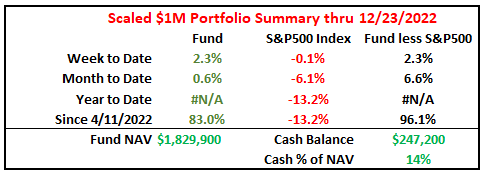

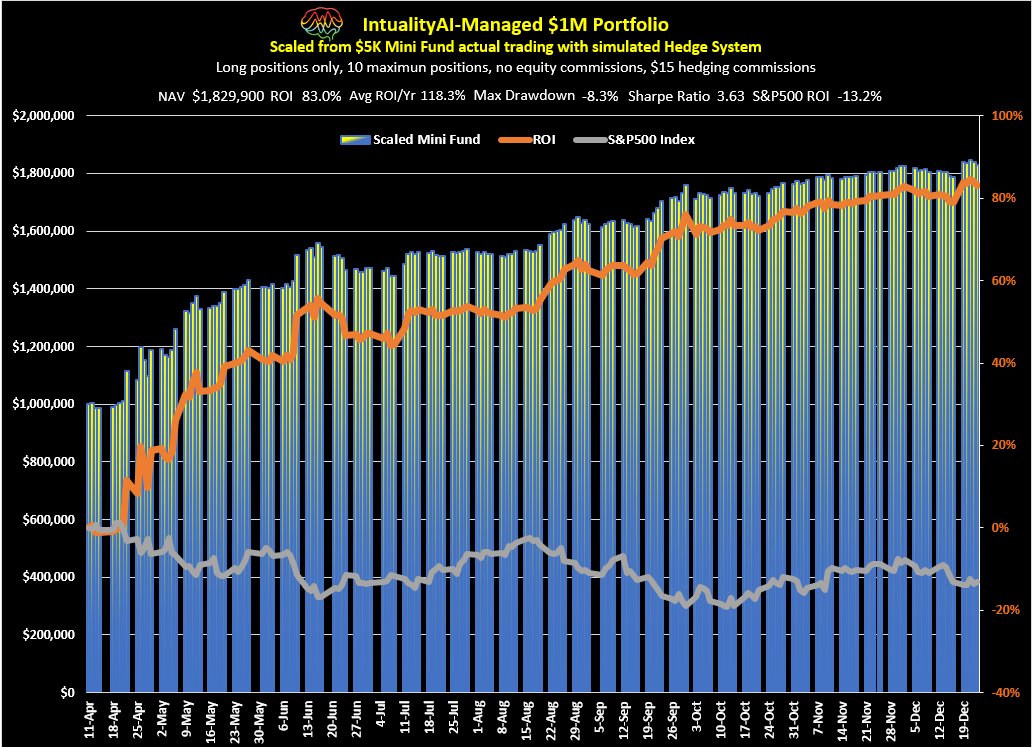

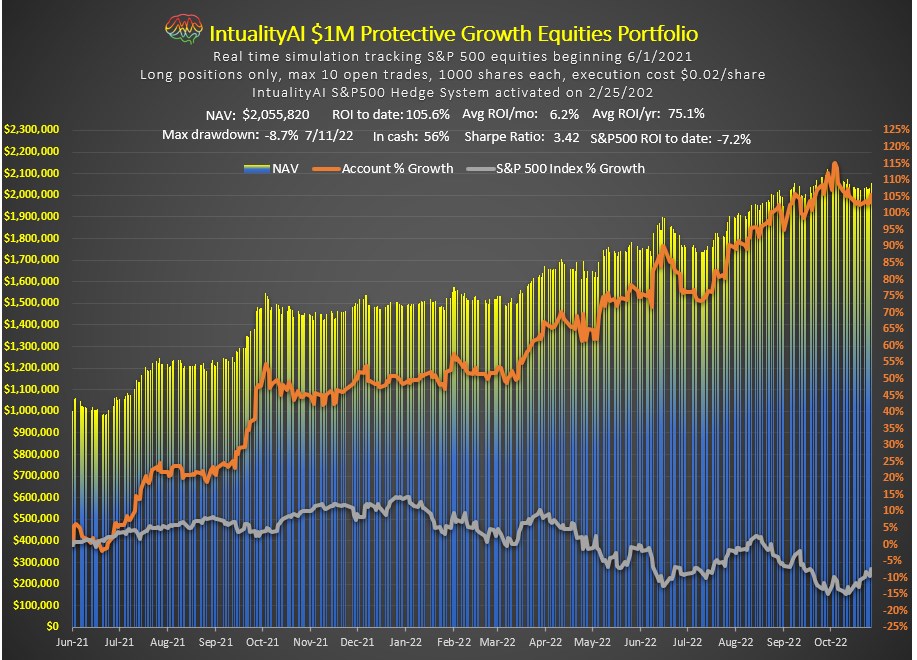

The foundation of our thrust is monetizing IntualityAI technology in 2023 as an equity fund composed of up to ten selected and continually optimized S&P500 equities. For the first time, this will involve a substantial real-money implementation of the successful $1 Million fund simulations we have back-tracked for more than 18 years, and tracked in 2022 for our readership with charts in these pages.

Our $5,000 real-money trading test in has shown an annualized 120% ROI, and that performance could have been scaled to a real million-dollar fund had that cash been available. As the S&P became poorer by -20%, many promising stock alternatives have also been hit even harder, and even IntualityAI did not achieve its annual performance without its hedging system. In fact, true to its reputation as a “Protective Growth Trading Platform” IntualityAI basically would have broken even in 2022, had it not also effectively shorted the market when it sense it was in decline.

We have seen similar outperformance statistics in most of our previous simulations. We now anticipate that a +4% monthly ROI is feasible even in the tough year that might be ahead, largely because of the system's baseline reasonably expected performance, combined with additional hedging upside if overall market averages sink.

AI stock prediction involves automated recognition of patterns and continual reaction to ongoing changes. This is why even the smartest investors must continually predict and adjust as necessary, making it extremely unlikely for long term predictions to be accurate. And smart investors now need an immensity of computerized , AI-enabled, and especially humanized AI, to be competitive.

by Michael Hentschel, anthropologist, economist, venture capitalist

This content is not for publication

©Intuality Inc 2022-2024 ALL RIGHTS RESERVED